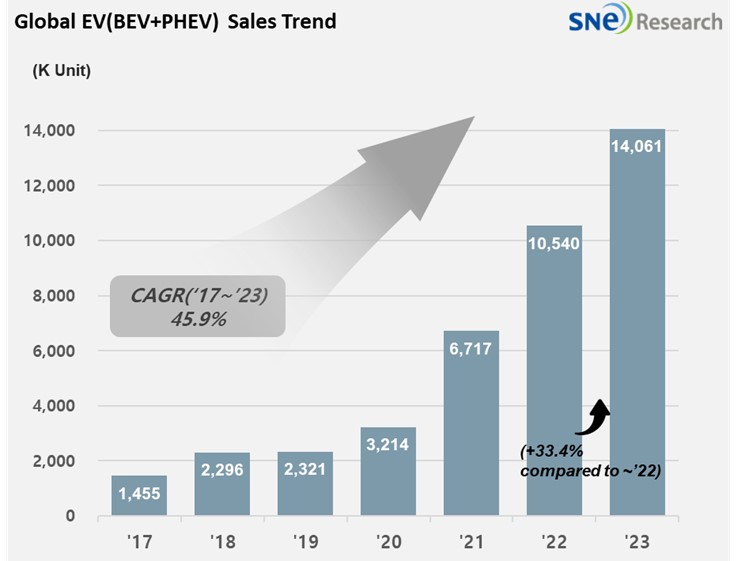

From Jan to Dec in 2023, Global[1] Electric Vehicle Deliveries[2] Posted 14.061 Mil Units, a 33.4% YoY Growth

- BYD ranked 1st, followed by Tesla in the global EV market.

From

Jan to Nov in 2023, the total number of electric vehicles registered in

countries around the world was approximately 14.061 million units, a 33.4% YoY

increase.

(Source: Global EV and Battery Monthly Tracker – Jan 2024, SNE Research)

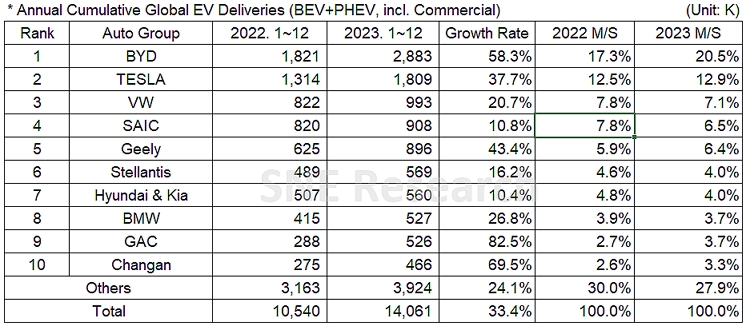

In the global EV sales by major OEMs from Jan to December in 2023, the leading EV company in China, BYD posted a 58.3% YoY growth, keeping No. 1 position in the global market. BYD accounted for the biggest pie in the market based on its variety of BEV and PHEV line-up including Song, Yuan Plus(Atto3), Dolphin, and Qin. Tesla ended the year of 2023 after delivering more than 1.8 million units to customers and recording a 37.7% YoY growth. Tesla saw favorable sales of its main models – Model 3 and Y – and particularly, Model Y made a significant contribution to the sales growth as more than 1.2 million units of Model Y were sold in 2023, recording a 60.8% YoY growth. The Volkswagen group, ranked 3rd on the list, posted a 20.7% growth by delivering approx. 990k units to customers mainly with ID series, Audi Q4, Q8 E-Tron, and Skoda ENYAQ model.

(Source: Global EV and Battery Monthly Tracker – Jan 2024, SNE Research)

Hyundai-KIA Group posted a 10.4% YoY growth by selling more than 560k units of IONIQ 5/6, EV6, Niro, and Kona. The Group, who broke the records of both sales and operating profit, announced that it would increase the sale of eco-friendly vehicles by continuously reinforcing hybrid line-up and improving the global awareness of its dedicated EV brand, ‘IONIQ.’

(Source: Global EV and Battery Monthly Tracker – Jan 2024, SNE Research)

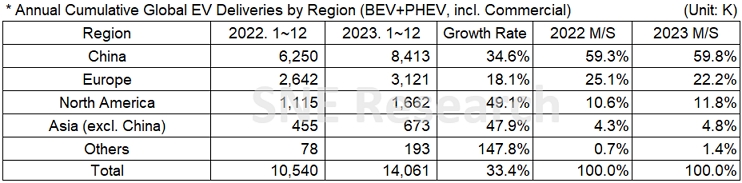

By region, China firmly kept its position as world’s biggest EV market, taking up 59.8% of the entire market share. Current growth momentum in China is led by BYD who both supplied battery to its own vehicles and manufactures electric vehicles, too, through its vertically integrated system. BYD, who secured high profitability through optimization of business structure and focused on new-energy cars after stopping the production of ICE vehicles, have sold approx. 2.771 million units in China in 2023. Given the total sales of new-energy cars in China in 2023 being 8.413 million units, it can be said that among 3 new-energy cars sold in China, one should be made by BYD.

Even after major countries in the world, including China, decided to terminate their EV subsidy programs or reduce the amount of EV subsidy at the end of 2022 and the repercussion effect of high interest rates, the global EV market in 2023 still saw a solid demand, closing the year at the yearly growth rate of 33.4%.

However, in 2024, those uncertainties related to a possible slowdown in EV demand are expected to linger. In addition, as early adopters have already purchased electric vehicles in the early stage, now the target should be customers who seek for electric vehicles at more reasonable prices with similar or better performance. In case of Korea, for example, a customer who wants to buy a new electric vehicle has to wait only for a month, while for hybrid vehicles customers are asked to wait for 20 months at most, showing that demand for electric vehicles has been slowed down at a faster pace than before. Amidst subsidy policies and fuel efficiency regulations getting tougher and charging infrastructure still being insufficient, it seems to be necessary to expand the EV line-up at affordable prices while the trend in EV market has shifted from vehicle performance-focused to price-focused.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period